A federal mortgage system also provides additional aide in order to Indigenous Us americans seeking get, re-finance otherwise rehabilitate a home, however, many potential applicants aren’t totally familiar with the applying advantages-otherwise your system can be found.

Congress founded the new Area 184 Indian Mortgage Be certain that System to help you generate homeownership easier for Local Us citizens and also to boost Local American communities’ usage of investment, with regards to the U.S. Institution from Homes and you may Urban Advancement (HUD). For the 2019, fifty.8% out-of American Indians and you can Alaska Residents had a home, than the 73.3% regarding low-Hispanic light Americans, depending on the U.S. Census Agency.

Finance through the Part 184 program need a minimal minimum down payment-basically dos.25%, otherwise only step 1.25% having money lower than $fifty,000-and personal Mortgage Insurance coverage (PMI) out of only 0.25%.

In contrast, Government Property Administration (FHA) financing individuals having an excellent FICO rating from 580 or even more you would like the absolute minimum down payment of 3.5%, when you’re people who have Fico scores between five hundred and you may 579 need a great 10% down payment, depending on the latest FHA Assistance having Borrowers. PMI normally run from around 0.58% to 1.86% of the amazing number of the loan, centered on 2021 investigation in the Metropolitan Institute.

« In the event you one to math, it creates a pretty massive difference, » said Karen Heston, elder financial banker which have BOK Monetary Home loan into the Oklahoma. The applying permits Native Us americans to order a property-and you will purchase seemingly absolutely nothing money up front to do so, she said.

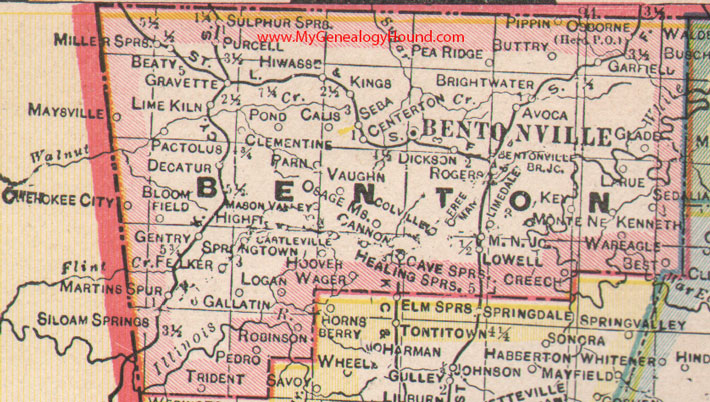

Currently, Area 184 mortgage loan fund try completely for sale in twenty-four states, and additionally Oklahoma, Washington, Tx, Kansas, New Mexico and you will Utah. During the fourteen says, in addition to Tx, New york and Connecticut, the latest fund are only for sale in certain counties and you will cities.

An entire directory of recognized credit parts is available with the HUD site. So you can qualify, you need to be a western Indian or Alaska Native who’s a person in a beneficial federally approved tribe.

Point 184 funds strange

Even with their extensive supply, financial lenders declare that Section 184 money compensate a somewhat brief portion of the loans it process. BOK Monetary is one of not absolutely all loan providers able to speed the newest techniques from the giving Part 184 finance on the part of HUD, rather than delivering records to HUD for approval.

From inside the Oklahoma, Mortgage Bankers Karen Heston and you will Terry Teel, said hardly any homeowners inquire especially about Point 184 finance, as they get be considered. As an alternative, the new bankers usually have to create in the system as a key part of one’s discussion.

By contrast, Elvira Meters-Duran, home loan banker on the BOK Monetary Mortgage, told you alot more Local Us citizens into the The fresh new Mexico was in person asking for the new funds.

« They’ve been payday loan Lakes West getting increasingly well-known while the Native people see there is certainly a particular tool out there in their eyes-especially today with the tribal residential property, » she said. « The fresh new tribal homes divisions are able to let users know that they are able to understand the purpose of home ownership using this kind of program. »

Particular whom inquire about the Point 184 funds don’t fully understand the way they performs, masters say. A standard myth is the fact that the program provides deposit advice, which it will not. The applying really does decrease the level of down-payment called for, however it does maybe not render money on advance payment.

Perhaps not a band-Help getting less than perfect credit

« They says on direction there is maybe not the absolute minimum borrowing from the bank score, which is a bit deceiving while the HUD is additionally awesome particular in the derogatory borrowing from the bank, » Heston said. The fresh new program’s created guidance wanted a personal debt-to-income proportion out-of only about 41%.

Just how to calculate the debt-to-income proportion

« The merchandise is actually in search of those who manage the borrowing from the bank in a timely fashion, » Teel concurred. « When you have marginal credit and you may collections, which is if it becomes a problem with these types of financing. »

Since a first action, candidates is always to speak to a mortgage banker to find out if it be considered and you will, or even, whatever they can do to fix you to definitely. Keeping secure work, to stop the new costs, repaying the present day debts and spending less can be all the let you meet the requirements in the future or even now, M-Duran told me.

« It’s just a fabulous device as home loan insurance policy is very reduced compared to an FHA loan. After that, you could piggyback they with down-payment otherwise closure rates guidance regarding tribe, » Teel told you. « It simply really helps a being qualified buyer enter a property having a good amount of money. »

Initiate Their Financing Now

Use on line with the HomeNow app otherwise contact a great Financial Banker to respond to the questions you have. In either case, we provide personal and you will conscious service to simply help show you owing to each step of the process.